FUND SNAPSHOT

| Type | An open ended scheme investing in arbitrage opportunities |

| Minimum Application | Rs. 5000/- and in multiples of Rs. 1 |

| Minimum Redemption | Rs.1000/- and in multiples of Rs. 0.01/- or account balance, whichever is lower. |

| Entry Load | Nil |

| Exit Load | - If redeemed/switched out within 7 days from the date of allotment: 0.25%

- If redeemed/switched out after 7 days from the date of allotment – Nil |

| Plans/Options | Direct & Regular – Growth & IDCW (Payout/Reinvestment) |

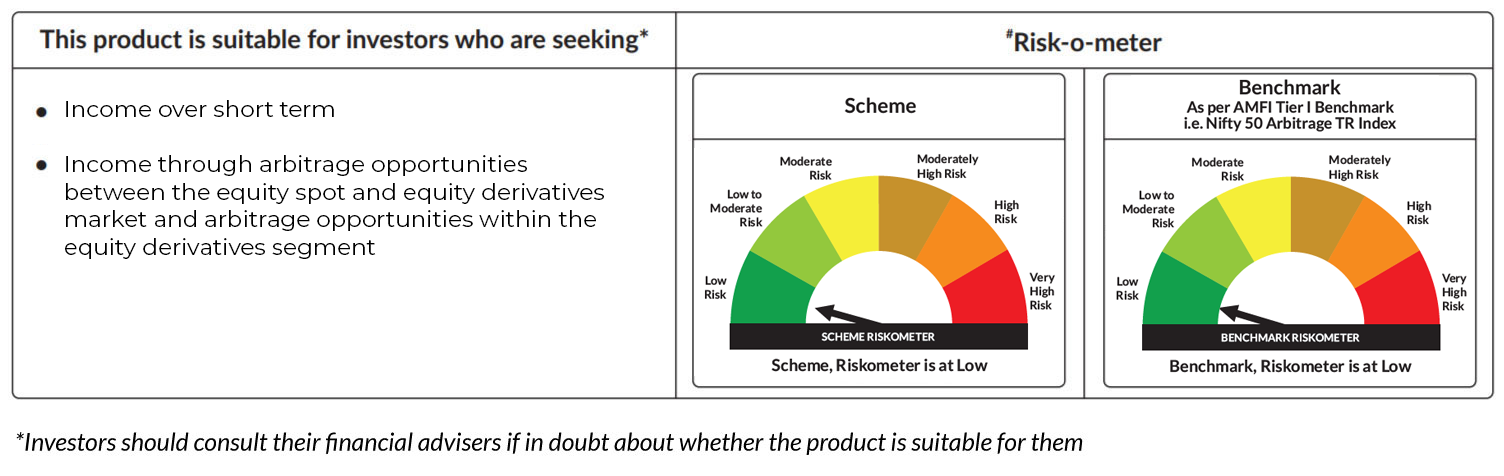

| Riskometer | Low |

| Benchmark | Nifty 50 Arbitrage TRI |

Risk-o-Meter

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund viz. www.oldbridgemf.com

Disclaimer: For further details, refer Scheme Information Document and Key Information Memorandum available on www.oldbridgemf.com. The document is given in summary form and does not purport to be complete. Old Bridge Asset Management Private Limited (OBAMPL) / Old Bridge Mutual Fund (OBMF) is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme. Neither OBAMPL/OBMF nor any person connected with them, accepts any liability arising from the use of this document. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate investment advice.