FUND SNAPSHOT

| Type | An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks |

| Minimum Application | Rs. 5000/- and in multiples of Rs.1 |

| Minimum Redemption | Rs.1000/- and in multiples of Rs. 0.01/- or account balance, whichever is lower. |

| Entry Load | Nil |

| Exit Load | If redeemed/switched out within 365

days from the date of allotment – 1%

If redeemed/switched out after 365 days from the date of allotment – Nil |

| Plans/Options | Direct & Regular – Growth & IDCW (Payout/Reinvestment) |

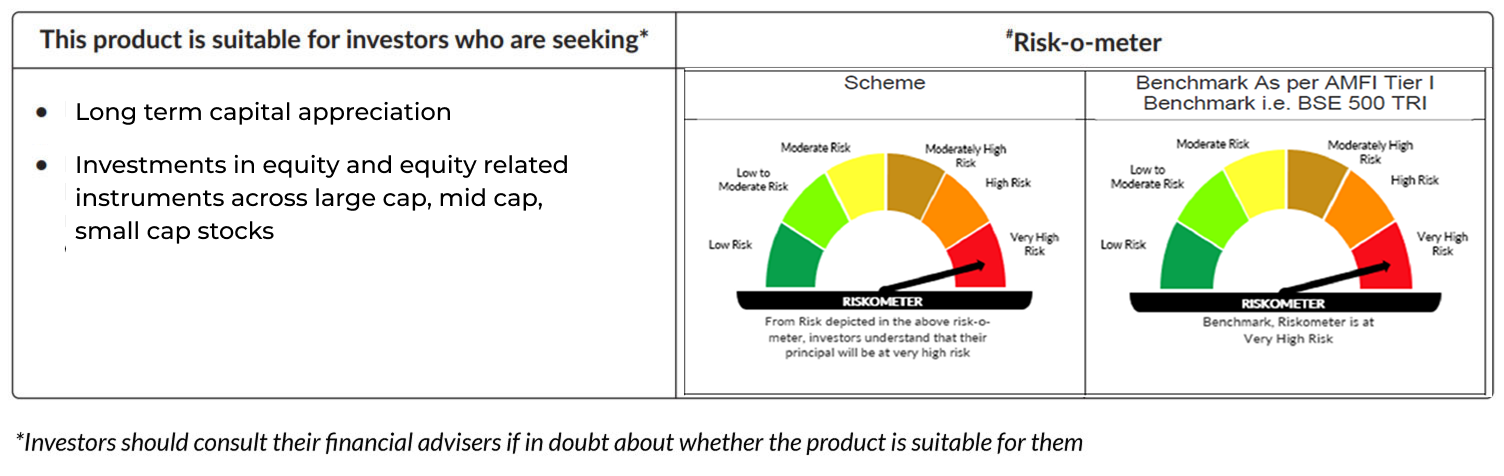

| Riskometer | Very High |

| Benchmark | BSE 500 TRI |

Risk-o-Meter

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. The above product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the scheme characteristics and the same may vary post NFO when the actual investments are made. For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund viz. www.oldbridgemf.com

Disclaimer: For further details, refer Scheme Information Document and Key Information Memorandum available on www.oldbridgemf.com. The document is given in summary form and does not purport to be complete. Old Bridge Asset Management Private Limited (OBAMPL) / Old Bridge Mutual Fund (OBMF) is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme. Neither OBAMPL/OBMF nor any person connected with them, accepts any liability arising from the use of this document. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate investment advice.